Copy trading allows investors to copy into their own personal accounts trades executed by other more experienced traders. Experienced traders provide this service for a fee, typically ranging from $50 to $500 per month. The explosion in online Self Directed Investing has caused Copy Trading’s popularity to balloon as well. There are multiple platforms and brokers that offer Copy Trading services – typically Manual or Automated.

Automated Copy Trading

The automated version links the investor’s account directly to that of the copied trader and executes the copied trader’s trades instantaneously in the investor’s account.

Manual Copy Trading

NuWealth currently uses the Manual version. While convenient, Automated trading is ill suited for small accounts as a single trade could wipe out the investor’s the whole account. In contrast, Manual Copy Trading allows the investor to review the CopyTrade Alert details and decide if the trade’s cost and risk/reward profile work for him. NuWealth is considering alternative smaller dollar copy trading providers that could work for those with small accounts.

What is NuWealth’s CopyTrade Subscription Fee?

Our monthly fee is $25. We expect to be in our Beta test phase through the end of 2022. If you Subscribe before December 31, 2022, you will receive CopyTrade Alerts free of charge for 1 year (through December 31, 2023).

What Strategies Do You Trade?

We trade Verticals and Iron Condors because they are versatile Defined Risk strategies that allow us to know before we place the trade the most we will profit if the trade goes in our favor and the most we will lose if it goes against us. If you are a new options trader, these terms may be unfamiliar to you. Don’t worry if you don’t yet speak “Option”. You will soon become fluent in the lingo.

How Will I Receive My CopyTrade Alerts?

Immediately after we execute a trade, we will send you a Text Message containing the trade string and Email you a detailed description of the trade. The email will include a GTC Closing Order trade string which will automatically close the trade once the trade hits our Target Gain. You should enter the Closing Order immediately after your opening order is filled.

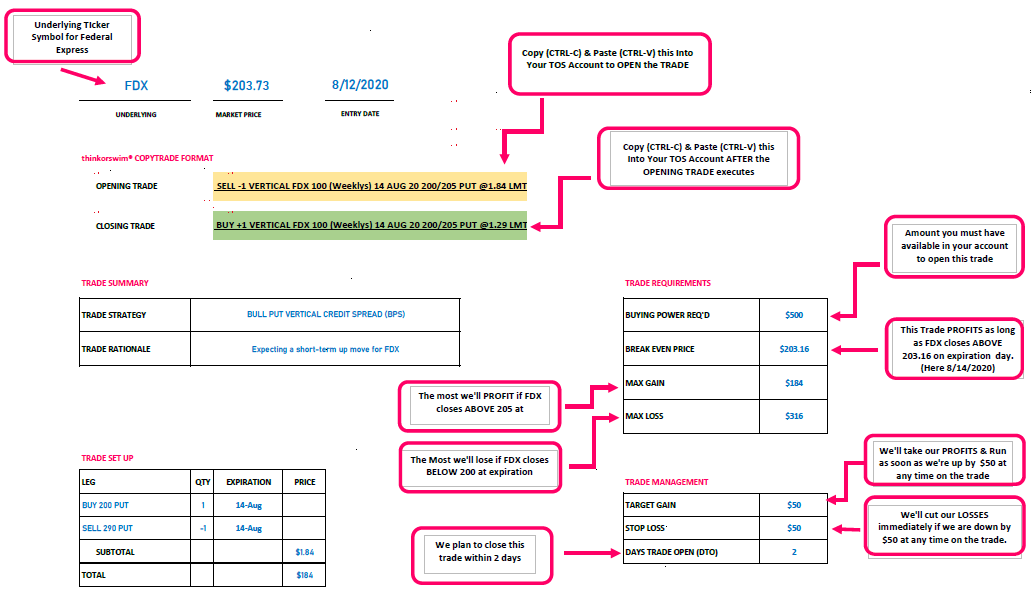

COPYTRADE TEXT ALERT SAMPLE

Federal Express (FDX) Bull Put Vertical Credit Spread

COPYTRADE EMAIL ALERT SAMPLE

Federal Express (FDX) Bull Put Vertical Credit Spread

FDX CopyTrade Alert Example.pdf

The trade strings are written in thinkorswim® format so that all you have to do is “Copy and Paste” them directly into your own TOS account. The “Copy and Paste” functionality only works with the thinkorswim® desktop platform. If you use the thinkorswim® mobile app or if you use a different brokerage firm altogether, you will have to enter the trade manually.

How Long Do I Have to Enter the CopyTrade Alert?

Don’t worry if you can’t copy the trade immediately. We know you have a life that doesn’t involve you staring at your trading platform all day long. Still, it’s best to enter the trade no later than 12 hours after the alert is sent. Be advised that the longer you wait to enter the trade, the greater the price adjustment you may have to make to get your trade order filled.