MARCH 2022 MARKET REVIEW

MAKING DOLLARS MAKES SENSE

The first quarter of 2022 is in the books and put simply, it was not pretty. Stocks plummeted, inflation surged, interest rates rose, and war broke out. Adding insult to injury -- because after all, what would injury be without insult thrown in – recession looms.

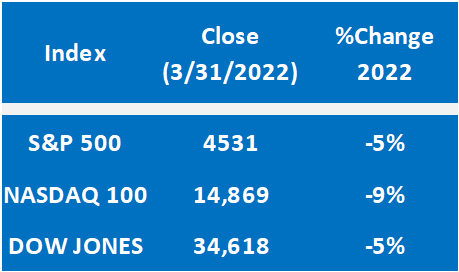

The S&P 500 ended Q1 down 5% with 10 out its 11 sectors reporting losses. The Energy sector was the sole winner. Led by Haliburton (37%), Occidental Petroleum (30%), and Exxon Mobile (23%), the sector posted a 39% gain making this its best quarter ever.

The tech heavy Nasdaq took a bruising (-9%) with 80% of its stocks closing down on the quarter. Among the biggest losers were Netflix, Facebook, and Zoom - all of which fell more than 30%.

Before you liquidate your 401k and stash the cash under your mattress, remember that pullbacks are a regular part of the market's ebb and flow process. Markets typically fall 5% to 10% every 2 years or so and recoup these losses in about 4 months. The last market retracement occurred in February 2020 (Corona Crash). While the S&P 500 plummeted 34%, it closed at a new all-time high just 6 months later.