2021 ETF PORTFOLIO & SMALL STAKES RESULTS - Copy

CORE ETF PORTFOLIO

$5,890

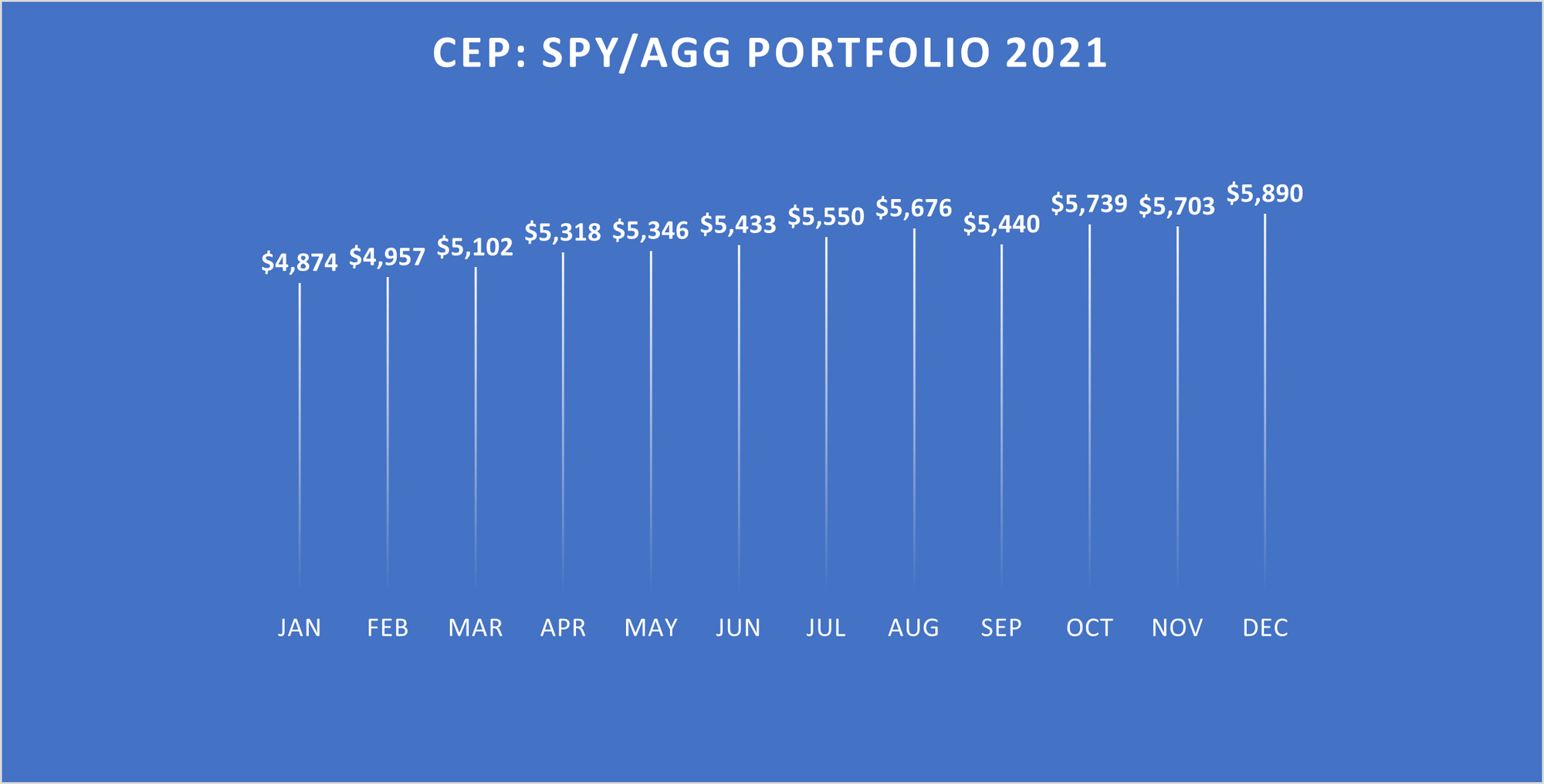

NuWealth’s 2021 Core ETF Portfolio (CEP) ended December 2021 at $5890, up $910 (+18%) from the initial $4980 invested on January 3, 2021.

CEP’s primary goal is to generate a short-term return of 3% to 5% within 3 months, while mirroring the longer-term returns of the typical moderate risk 401(k) mutual fund portfolio. The CEP is a combination investment in which we allocated $5,000 between SPY (75%) and AGG (25%) - 2 of the most heavily traded Exchange Traded Funds (ETFs) on the market. SPY is an equity ETF that tracks the S&P 500 index. AGG is a fixed income ETF that tracks the Barclays U.S. Investment Grade Bond Index.

SMALL STAKES MONTHLY INVESTMENT

$1302

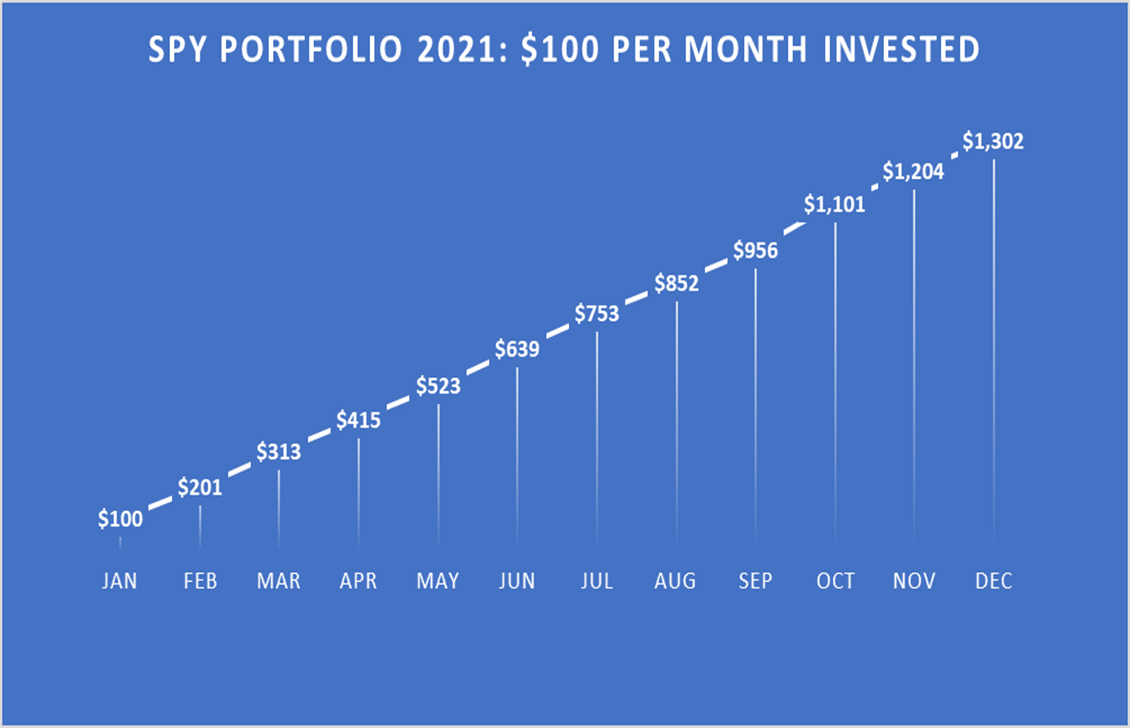

A $100 investment in SPY each month would have grown to $1302, a $102 (+8%) gain in 2021 assuming all dividends were reinvested. Thus, you do not need to have a large cash hoard to start investing. Indeed, the regular and continuous investing of small sums can pay off significantly even over a brief period of time. Since SPY is currently priced at approximately $430 share, you would need to have an account with a broker that permits fractional share purchases (such as Schwab, SoFi, or Betterment). At the time of this writing, thinkorswim® does not have a fractional share purchase feature.