NUWEALTH’s ETF PORTFOLIO UPDATE - Nov 20, 2020

$5,676

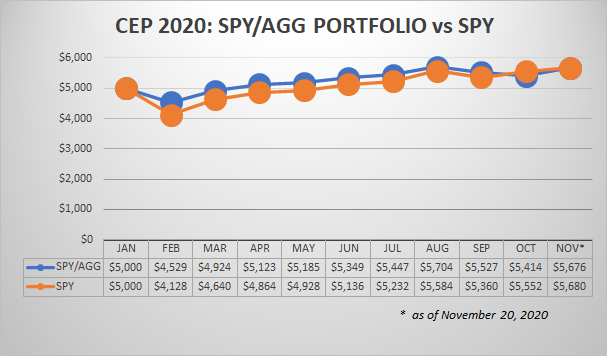

NuWealth’s Core ETF Portfolio (CEP) closed the week at $5,676, up $676 (14%) Year to Date. The S&P500 ended the week down slightly at 3558. The S&P 500 benchmark portfolio is up 14% Year to Date as well.

WHAT IS THE CORE ETF PORTFOLIO?

NuWealth CEP’s primary goal is to generate a short-term return of 3% to 5% within 3 months, while mirroring the longer-term returns of the typical moderate risk 401(k) mutual fund portfolio. The CEP is a combination investment in which we allocated $5,000 between SPY (75%) and AGG (25%) - 2 of the most heavily traded Exchange Traded Funds (ETFs) on the market. SPY is an equity ETF that tracks the S&P 500 index. AGG is a fixed income ETF that tracks the Barclays U.S. Investment Grade Bond Index.

IS THERE A MINIMUM OR MAXIMUM PORTFOLIO HOLDING TIME?

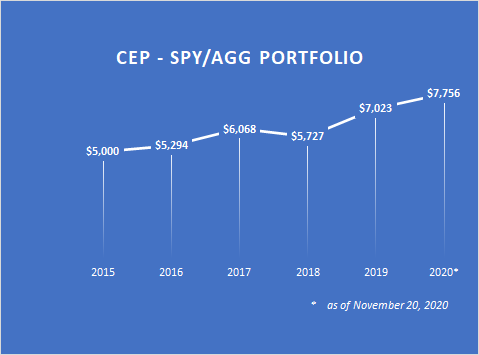

Suggested minimum of 3 months. No maximum. CEP can yield attractive short-term returns, but can also be held as a long-term investment. When viewed over a 5-year period, a $5,000 CEP investment made in 2015 would be worth $7,756 today, a gain of over 50%.

DISCLAIMER

Neither NuWealth Trading, Inc (Company) nor any of its owners, managers, employees, agents or independent contractors is, in such capacities, a licensed financial advisor, registered investment advisor, registered broker-dealer or FINRA | SIPC | NFA- member firm. Examples presented on Company’s website including video tutorials, indicators, strategies, articles, emails, reports, downloads, and all other content of Company’s products are provided for informational and educational purposes only.