NUWEALTH’s ETF PORTFOLIO RESULTS - Jan 8, 2021

Friday, January 8, 2021

MAKING DOLLARS MAKE SENSE

NuWEALTH’s Weekly Market Summary

Stocks roar into 2021 with the S&P 500 (2%) and the Nasdaq (1.7%) soaring to new All-Time-Highs. Markets appear unfazed by U.S. political unrest, record-breaking COVID19 deaths, and the worst monthly jobs report since the March 2020 Corona Crash. Instead, analysts attribute this week’s increase to expectations that the Democratically controlled Congress will pass enhanced COVID19 related stimulus support.

WHAT IS THE CORE ETF PORTFOLIO?

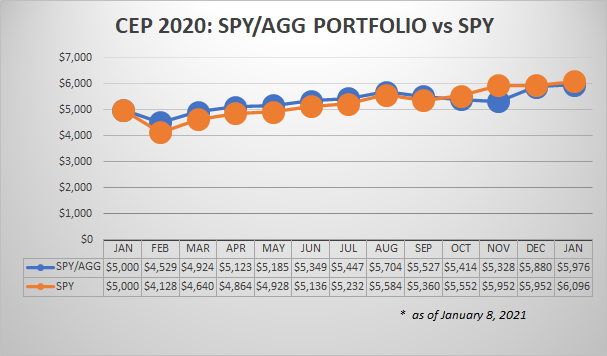

NuWealth CEP’s primary goal is to generate a short-term return of 3% to 5% within 3 months, while mirroring the longer-term returns of the typical moderate risk 401(k) mutual fund portfolio. The CEP is a combination investment in which we allocated $5,000 between SPY (75%) and AGG (25%) - 2 of the most heavily traded Exchange Traded Funds (ETFs) on the market. SPY is an equity ETF that tracks the S&P 500 index. AGG is a fixed income ETF that tracks the Barclays U.S. Investment Grade Bond Index.

IS THERE A MINIMUM OR MAXIMUM PORTFOLIO HOLDING TIME?

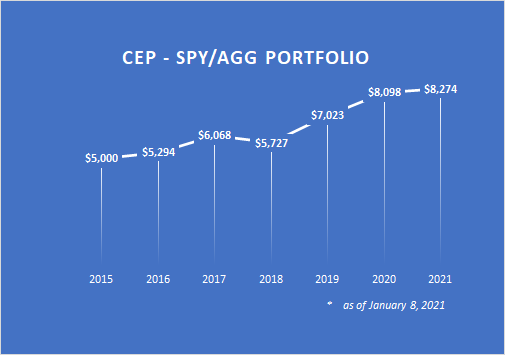

Suggested minimum of 3 months. No maximum. CEP can yield attractive short-term returns, but can also be held as a long-term investment. When viewed over a 5-year period, a $5,000 CEP investment made in 2015 would be worth $8,274 today, a gain of over 50%.