NUWEALTH’s ETF PORTFOLIO RESULTS - April 30, 2021

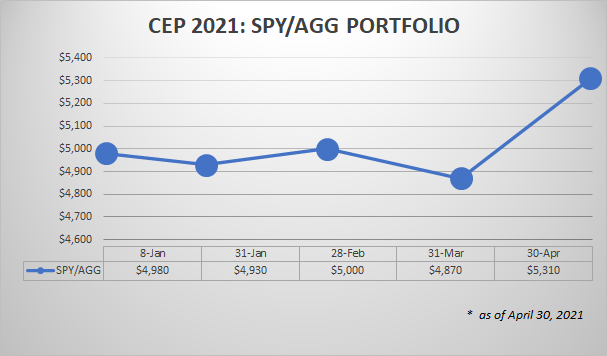

$5,310

NuWealth’s 2021 Core ETF Portfolio (CEP) is up $330 (7%) on the year despite recent large declines in the the Nasdaq and Russell 2K. The S&P 500 benchmark portfolio against which we compare CEP’s performance is up 9% since January 2021.

WHAT IS THE CORE ETF PORTFOLIO?

NuWealth CEP’s primary goal is to generate a short-term return of 3% to 5% within 3 months, while mirroring the longer-term returns of the typical moderate risk 401(k) mutual fund portfolio. The CEP is a combination investment in which we allocated $5,000 between SPY (75%) and AGG (25%) - 2 of the most heavily traded Exchange Traded Funds (ETFs) on the market. SPY is an equity ETF that tracks the S&P 500 index. AGG is a fixed income ETF that tracks the Barclays U.S. Investment Grade Bond Index.

IS THERE A MINIMUM OR MAXIMUM PORTFOLIO HOLDING TIME?

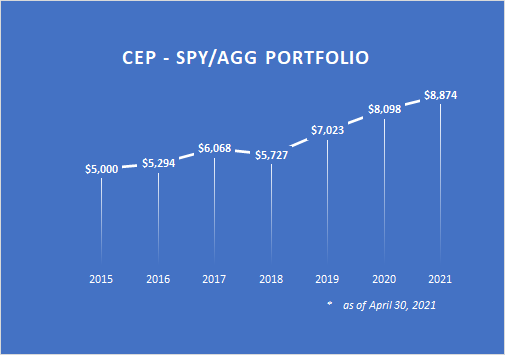

Suggested minimum of 3 months. No maximum. CEP can yield attractive short-term returns, but can also be held as a long-term investment. When viewed over a 6-year period, a $5,000 CEP investment made in 2015 would be worth $8,874 today, a gain of over